|

| The bulls are dead |

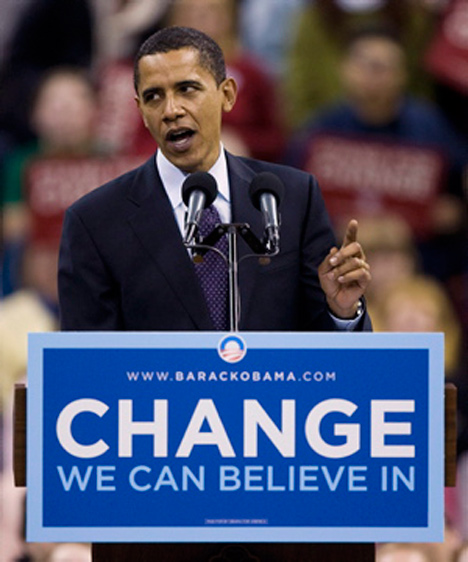

Landers, CA— Six years ago, just weeks before the 2008 General Election, we had what is now called The Great Recession. The Republicans were in office, and the Democratic nominee, Senator Barak Obama, blamed the government and Wall Street for what had happened. Obama renewed his calls for “Change we can believe in!” And Americans bought it, and the senator became the president, and we’ve had six years of “good times.” But yesterday, when I woke up, it was to hear FOX News’ Shepard Smith screaming that this was one of the worst financial disasters is American history.

As the stocks plunged and those who had bought supposedly

safe securities in America, China, and around the world started losing money,

billions, possibly trillions of dollars gone in hours, the other stock that was

dropping was Obama, and he now looks like a much worse investment than he did

to his liberal supporters six years ago.

The reason Wall Street fell in 2008 was hashed out in the months

that followed, and it turned out that corporate greed, slipshod regulations,

and the massive over lending of banks caused millions of Americans to lose

their retirement, their jobs, and their life savings. The Subprime Mortgage Crises

was caused by banks who lent money to people they knew could never pay it back.

But when the bills came due, the housing market bubble blew up in Wall Street’s

face, and normal people were forced to bail them out. In turn that caused a

domino effect which started the worst economic downturn since The Great

Depression.

But this is all familiar territory, it is past history. But the

story of today is a story that is nowhere near finished. An earthquake has just

happened, and the aftershocks are reverberating all around the globe. We don’t

even yet know if the main earthquake is over yet, or if perhaps this was just

the beginning of a terribly long road which we will emerge from years from now,

with the emerging nations humbled, the third world all but destroyed, and all

of us civilized, “industrialized nations” engaged in a vicious blame game.

The good news is that, this morning, in the West, stocks

began to bounce back as people sought to make profits by buying cheap. However,

in the east, especially China, where the housing market has burst, where they

have not completely recovered from 2008, and their currency has been devalued,

and where economic growth in the nation of over a billion people is slowing

down, things continue to look bad. Since the 12th of June, Chinese

Stocks have fallen 38%, and in the first half of the year, the government’s

revenue was down by nearly a quarter from the same period the year before.

The current line among those “in the know” is that fears

about China’s collapsing economy was really what caused the massive overnight

selloff in America, causing the huge losses at the New York Stock Exchange. If

that is true, it of course comes as no surprise that China’s economy, which is

run by an authoritarian communistic government, where the people have little

freedom, regulation is rife and many industries are still nationalized, should

have collapsed. What is discouraging is that, despite the obvious weakness of

any communist nation’s economy, America’s own economy should have been tied so

close to China.

The current line among those “in the know” is that fears

about China’s collapsing economy was really what caused the massive overnight

selloff in America, causing the huge losses at the New York Stock Exchange. If

that is true, it of course comes as no surprise that China’s economy, which is

run by an authoritarian communistic government, where the people have little

freedom, regulation is rife and many industries are still nationalized, should

have collapsed. What is discouraging is that, despite the obvious weakness of

any communist nation’s economy, America’s own economy should have been tied so

close to China.

But one reason, I believe will have to be looked at, is the

euphoria of recent years due to the Federal Reserves' artificially low interest

rates. The pundits have been saying for months that when the Fed’s decided to

tighten the interest rates, it would prompt a market selloff, and a

“correction” in the stock market. The polite way of saying there would be a

small crash. And the Federal Reserve has announced in the coming weeks they

will very likely be raising the interest rates to more market sustainable

levels.

In the past few years, with interest levels low and loans

easy to come by, the money from those loans was being dumped into national

economies, such as China, but also Latin America, where there was less security

than America or Europe, but also higher possible gains. But now that the Fed is

threatening to end this unsustainable era of cheap money, investors are seeking

to liquidate their assets in these emerging markets, and are helping to fuel

their collapse. Across South America today, the stock markets are being hard

hit, as are those of Hong Kong and Taiwan, as oil drops to below 40 dollars a

barrel, which is good news for us, the consumers, and bad for those own the

company, and in the long run, if this trend continues, it is bad news for the jobs

of those who work in the industry, as low prices nearly always lead to

shrinking production.

So one is left wondering, why did this happen, again? Why was

the bubble once again blown up until it got pricked? Like a plane that was

allowed to go beyond the speed of sound, the sound waves begin piling up at the

front of the plane, or the market that tries to defy the rules of the market,

and eventually they create a massive sonic boom, and all the damage that that

entails. It is, of course due to the flawed

ideology of the Federal Reserve. The promised “change we can believe in” at

least on this, has not happened. The bubble was allowed to grow again, and of

course, like any bubble, it popped, taking down all those who were riding it.

This is not to say that the president, had he made all the

right choices, could have permanently avoided a boom-bust cycle. Downturns

happen even in the freest of free markets, unhindered by the likes of the

Federal Reserve; that is simply the cycle of capitalism. But when capitalism is

messed with, when the “hidden hand” is foiled, then things may look better for

a time, but in the end they will always get worse, because no one can play with

the market and expect everything to come out all right.

But even at this hour the government can in some small way

atone for its mistakes by not repeating those of the American government at

other times when there have been recessions or depressions. They can leave the

market alone. It’s not the most politically expedient thing to do, and it will

require the administration and the Fed to exert massive self-control, not

something politicians are good at. But sticking your hands in the pie only ever

makes it worse.

Andrew C. Abbott

No comments:

Post a Comment